- Research project

- – Western Pacific

If we are serious in our efforts to meet the sustainable development goal 6 of access to safe water supply, sanitation and hygiene (WASH) for everyone, especially in the face of climate change, there will need to be significantly more investments to overcome the substantial gap between the public funds that are available, and the finance needed to tackle the challenges communities are facing due to a changing climate.

This is the challenge that the International Water Centre (IWC), in partnership with Lean Finance and with the support of the Department of Foreign Affairs and Trade (DFAT), have been grappling with over the past year. Recent outputs from their research points to possible solutions through the more sophisticated approaches in blended finance.

“There is no doubt that climate change increases failure rates in existing infrastructure, which will require either new systems or retrofitting of the old systems,” says Dr Regina Souter from the IWC.

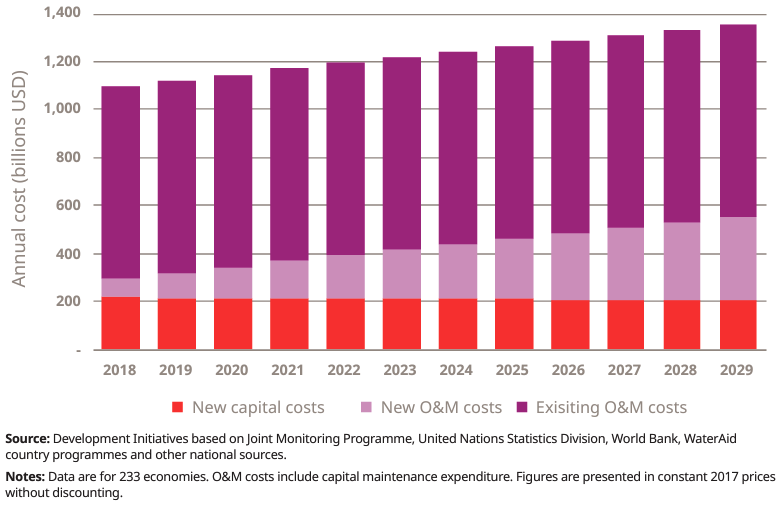

“In a recent report, Blueprint: financing a future of safe water, sanitation and hygiene for all, published by WaterAid in May 2021, the cost to deliver universal climate-resilient WASH will reach 14 trillion USD by 2030,” Regina said.

“We wanted to know whether blended finance could work to benefit WASH and in what situations. What we found was that you need a strong enabling system, and then the investors will follow. Blended finance will not resolve all the financing issues, but it does offer a more holistic approach to finding capital from non-traditional sources.”

Figure 1: New and existing global costs over 2018-2029 to reach safely-managed, climate-resilient WASH by 2030

(WaterAid, Blueprint: financing a future of safe water, sanitation and hygiene for all. 2019)

According to Oksana Tkachenko, Founder of Lean Finance, organisations need to make the best use of existing assets and resources, minimise their future needs and investigate additional revenue opportunities that could be generated by taxes and tariffs, before trying to harness additional sources of finance as part of the money transfers.

“We also need to consider the way existing finances are used and whether there are smarter ways to increase efficiencies and effectiveness of WASH services, such as through nature-based solutions, innovation, and circular economy principles. This can increase the longevity and resilience of WASH services, reducing the need and reliance on additional sources of capital.”

Blended finance is a partnership of various financial “actors”, working together to combine different sources of capital with innovative financing structures. It provides an opportunity for the public sector to leverage their own funds by accessing private funds. They can do this by providing publicly sourced capital that has a high tolerance to financial risk (e.g. grant, subsidy, guarantee, or first-loss capital) so that private (or other) investors’ financial returns are more “protected”, and thus private sector more willing to participate.

The ‘blending’ can manifest in many ways. For example, the blending of capital to create an investment pool, the blending of financial tools within an investment pool, the blending of portfolios of funds for deployment by a sector or a region, or blending of different types of activities and enterprises, or of different types of organisations and functions.

To inform public audiences about the potential positive impacts and challenges of blended finance, the team generated some evidence by performing a case study assessment of past examples. The assessment focused on the financial arrangements of such initiatives and explored their potential for positive development and social impacts, and their scalability or ability to be repurposed.

The five case studies selected involved WASH projects that were initiated on the basis that public funds alone would not be sufficient to drive systemic change in the sector and to realise WASH development impacts at scale. Among the five projects, two were focused on sanitation services, while the others sought broader opportunities across the water sector. All initiatives were executed in low- and middle-income countries, including countries in the Indo-Pacific region. The case studies feature some form of blending (2 cases), leveraging (2 cases), or linking (1 case) public and private capital to expand and offer WASH products and services to low income, marginalised and/or unserved populations, and to close affordability and financing gaps.

The case study report assesses the following WASH initiatives

Some of the key findings included:

The report includes other specific recommendations for Development Partner seeking to catalyse blended finance for WASH.

A key recommendation from the case study assessments was that Development Partners wanting to catalyse blended finance for WASH should conduct a diagnostic assessment to guide locally appropriate and effective initiatives.

To support this recommendation, the IWC and Lean Finance team developed a diagnostic assessment tool (leveraging on best practice methods and principles, developed by other agencies, mainly USAID and OECD) that can be applied to a specific country.

The diagnostic assessment tool includes six steps:

The process to develop the diagnostic tool involved a practical application in Cambodia. IWC and Lean Finance worked with two locals, Andrew Shantz and Ang Len, to ensure good stakeholder engagement and understanding of the local context throughout the diagnostic assessment.

The assessment for Cambodia indicated moderately high investment attractiveness, due to favourable macroeconomic conditions in the country, such as stable economic growth, increasing consumer savings, favourable policies for foreign investments (in fact the best compared to most ASEAN countries), an improving corruption index, a favourable trend in some business indicators, and a moderately-to-highly developed WASH sector.

Considering the complexity and breadth of WASH gaps in Cambodia, a programmatic, systemic approach to WASH financing in Cambodia that blends various types of investment capital was identified as the most appropriate path towards blended finance for WASH. This would provide investment capability and access to finance for the sector as well as subsidies (grants, technical assistance), with the intent of strengthening the market, supporting sectoral outcomes, and forming the pathway for enhanced scalability and viability.

According to Regina, partnerships are the key to identifying appropriate and effective strategies to blend finance for WASH.

“Good partnerships are critical to ensuring that financing arrangements are attractive and appropriate for all actors involved, including WASH consumers, that WASH service providers and enterprises are financially ready and have the capacity to deliver good quality, resilient and inclusive services, and that enabling environments and governance protect and support investors, service providers and WASH consumers. These partnerships include investors, fund managers and WASH enterprises but also might include Civil Society Organisations and others that can assist with building local technical capacities.”

“While effective collaboration between financial, WASH and local expertise may be time-consuming, it is critical to understanding the whole system and where opportunities and constraints lie,” Regina said.

More information about the research of IWC and Lean Finance is available on their website: International WaterCentre – Blended Finance

During the upcoming Water, WASH and Climate Online Symposium, held as part of the Water and WASH Futures knowledge forums, the IWC and Lean Finance have partnered with WaterAid to convene a case study and panel session on Partnerships for scaling-up private sector financing of WASH. The online session, on the 23rd June, is free to attend, but registration is required – for more information visit Water, WASH and Climate – Water & WASH Futures

Oksana Tkachenko is the founder of Lean Finance and currently works on a range of financing projects in the WASH sector.

Dr Regina Souter is a Senior Research Fellow at the International WaterCentre, and currently working on research and education activities relating to WASH and integrated water management.